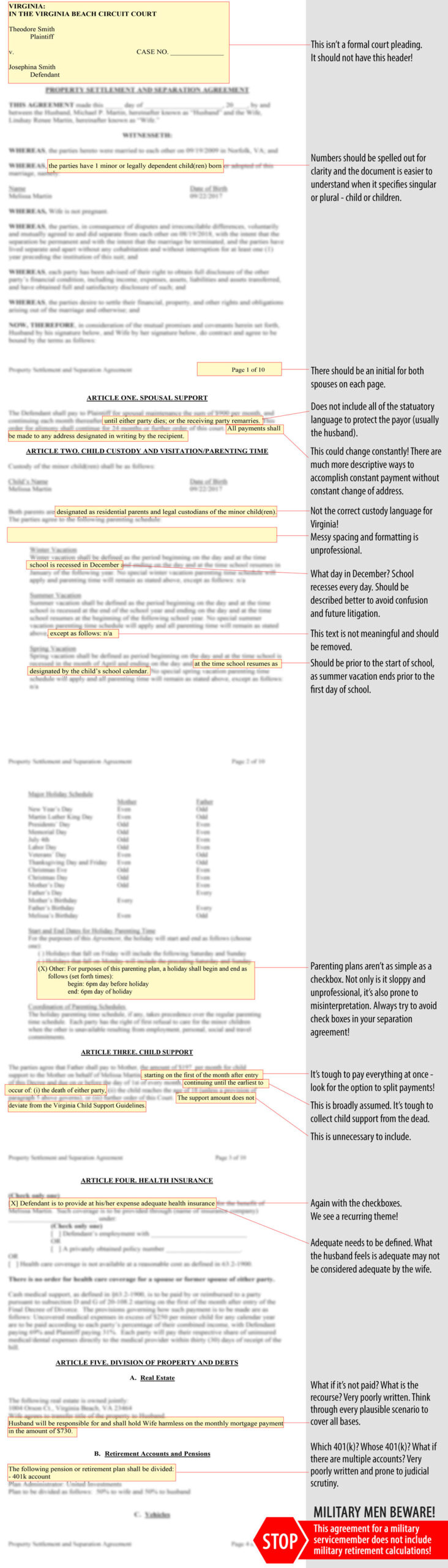

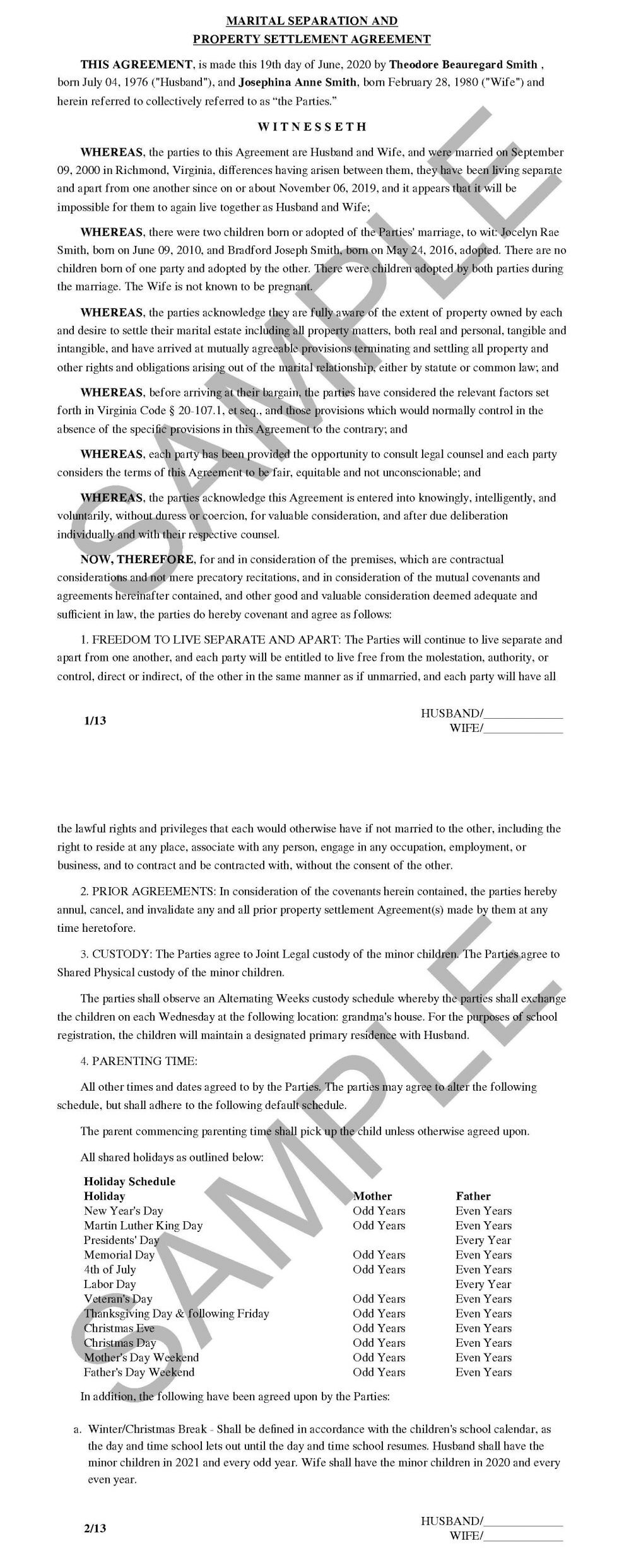

With a Virginia separation agreement, you must capture every asset you and your separating spouse may have. That includes military retirement pension, even if you will not see its cash benefits for decades. Your spouse has a right to a share of your military retirement pay.

10/10

A military pension is divisible marital property in Virginia. Whether married five or 50 years, the couple can have the military pension divided by a state court. A myth exists that you must be married 10 years before the pension is divisible; that’s wrong.

That myth stems from this truth: for the Department of Defense to make direct payments to a former spouse, the couple must meet two conditions:

- The marriage lasted a minimum of 10 years that …

- Overlapped military service of a minimum of 10 years

So if you join the military, serve 10 years, and coincidentally marry your spouse the same day you enlist, your marriage and service coincide and she is entitled to an equitable share of your military pension payable from DoD.

Remember, though, even a marriage of just a few years can produce a military pension that is marital property and subject to division in Virginia separation and divorce.

50-50

Virginia’ law governing division of military pensions is § 20-107.3. Under section G of the law we find:

The court may direct payment of a percentage of the marital share of any pension, profit-sharing or deferred compensation plan or retirement benefits, whether vested or nonvested, which constitutes marital property and whether payable in a lump sum or over a period of time. … No such payment shall exceed 50 percent of the marital share of the cash benefits actually received by the party against whom such award is made. … Any determination of military retirement benefits shall be in accordance with the federal Uniformed Services Former Spouses’ Protection Act (10 U.S.C. 1408 et seq.).

The Uniformed Services Former Spouses’ Protection Act (USFSPA) gives each state the right to treat military pensions as marital property to be divided. Virginia sets a cap of 50 percent of the pension. That’s right: your spouse can get half of your military pension.

Separated or Divorced

Whether you and your spouse are about to separate, have already separated and filed for divorce, or are already divorced, he or she is entitled to their share of your military pension. During separation, initial arrangements laid out in a property settlement agreement (aka separation agreement) will be in force. These arrangements include issues such as:

- Child custody and support

- Spousal support

- Division of assets and liabilities

The initial arrangements for separation are not a trial run; they establish the rules, terms, stipulations, and details for property division effective the date of divorce. Getting the military pension properly divided must happen early in the process.

Undervalued

The value of the military pension may not seem significant during the initial stages of separation, but as a divorce date looms, the cash value of that retirement becomes significant. You cannot afford to treat a deferred benefit like a military pension any differently than you would a tangible, valuable asset like jewelry or stock shares.

Unfortunately, too many couples undervalue the retirement benefit and its significance. Any agreement can later be appealed, but why wait to clean up a mess you can prevent? Your better strategy is to get the correct division of that pension going into the property settlement agreement, rather than attempt, years later, to relitigate its distribution.

BRS or High-3

Civilians may be confused by the two military retirement systems currently operating:

- Blended Retirement System (BRS) — The modern military’s answer to civilian 401(k) retirement plans, the BRS is a defined contribution plan

- High-3 — The legacy system is a defined benefit plan, named for a benefit determined by your highest three years of basic pay

The marital property value of the retirement can be expressed one of two ways:

- As a fixed dollar amount, or

- As a percentage of disposable retired pay (gross retired pay less allowable deductions)

In the words of the Defense Finance and Accounting Service (DFAS), “if the parties are divorced while the member is still on active duty, the former spouse’s award may be expressed by an acceptable formula or hypothetical retired pay award.”

If you and your separating spouse can agree on a percentage and include that, rather than a dollar figure, in your property settlement agreement, you can save yourself endless aggravation later.

For the most accurate, strongest separation and divorce documents, come to TheFirmForDivorce.com. We produce papers accepted by Virginia’s courts, true to Virginia’s laws, for Virginia’s men.